Risk Management

KIC controls investment losses and minimizes unnecessary risk through

preemptive and systematic risk management.

KIC aims to control investment risk within certain limits and appropriately manage potential losses. We have established a risk management system that provides comprehensive control solutions for managing risk at every step, for not only the front, middle and back offices, but also corporate management.

The Steering Committee reviews and deliberates on risk management policy while the Board of Directors (BOD) allocates risk limits and risk management guidelines.

The Risk Management Subcommittee (under the Steering Committee) and the Risk Management Working Committee (under the BOD) arrange detailed risk management guidelines via in-depth discussions.

The Risk Management Division is strictly separated from the Investment Management Division to ensure the independence and autonomy of the risk assessment and investment monitoring processes.

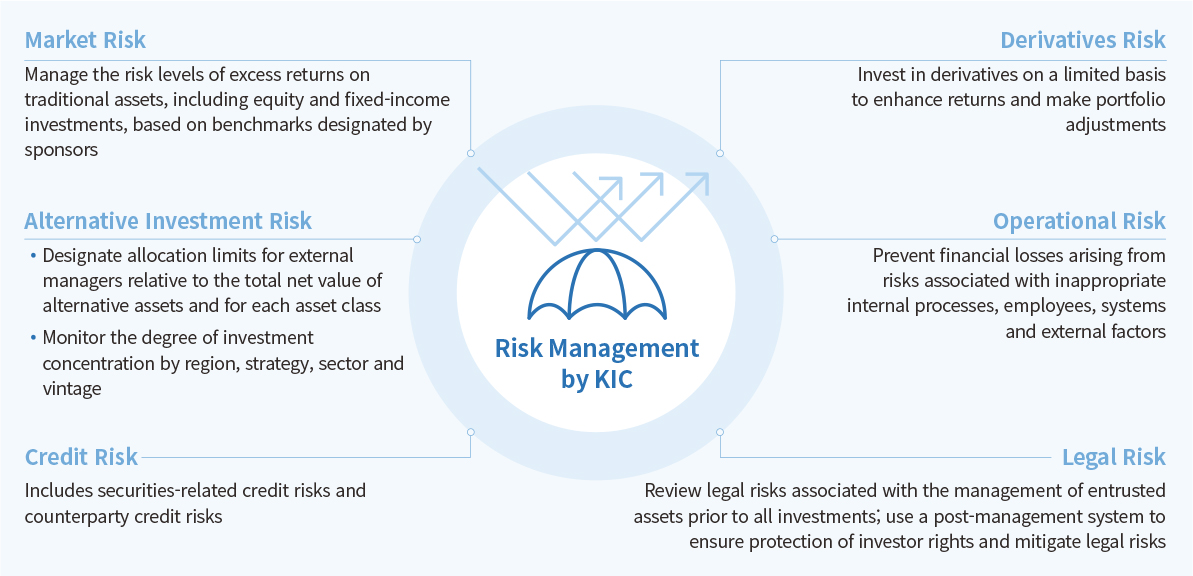

KIC manages market risk, credit risk, derivatives risk, operational risk and legal risk. We adopt quantitative indicators and limits to measure each type of risk and assess and monitor each risk indicator during the investment process. When key risks exceed limits, the Risk Management Working Committee examines the issue and discusses possible solutions.

To supplement quantitative analyses, we also perform various types of qualitative analyses.

- Market Risk

- Manage the risk levels of excess returns on traditional assets, including equity and fixed-income investments, based on benchmarks designated by sponsors

- Alternative Investment Risk

-

- Designate allocation limits for external managers relative to the total net value of alternative assets and for each asset class

- Monitor the degree of investment concentration by region, strategy, sector and vintage

- Credit Risk

- Includes securities-related credit risks and counterparty credit risks

- Derivatives Risk

- Invest in derivatives on a limited basis to enhance returns and make portfolio adjustments

- Operational Risk

- Prevent financial losses arising from risks associated with inappropriate internal processes, employees, systems and external factors

- Legal Risk

- Review legal risks associated with the management of entrusted assets prior to all investments; use a post-management system to ensure protection of investor rights and mitigate legal risks

Market Risk

For traditional assets including equities and fixed income, KIC manages the risk levels of excess returns based on benchmarks designated by our sponsors. Public market risk is defined as the volatility of excess returns against the benchmark, and we measure, monitor and set limits using ex-ante tracking error (T/E). In 2020, the ex-ante T/E (minimum - maximum) for KIC’s total portfolio was 30-61 bps and managed within limits. The tracking error for equity was within 54-111 bps and for fixed income, 31-54 bps. A key source of alpha generation, these tracking errors are effectively allocated and managed across investment strategies.

We also use a variety of tools and approaches to prepare for multiple investment risks. Value at Risk (VaR) estimates portfolio volatility in accordance with asset management goals for absolute returns in asset allocation. We also measure and monitor indicators such as conditional VaR (or expected shortfalls) and use stress tests that incorporate not only historical scenarios, but also hypothetical scenarios including uncertainties in the interest rate policies of major countries and Covid-19-related economic outlooks to estimate investment losses from multiple perspectives.

To supplement the quantitative models, we backtest the effectiveness of various risk models, designate investment-eligible products in advance and manage weights for each asset class, country, currency and sector, the allocation limits for external managers and duration limits. We also analyze the portfolio establishment scheme and risk management status of major global institutional investors and meet with them in an ongoing effort to improve our risk management system.

Lastly, we closely monitor financial market trends by reviewing key market risk factors and analyzing their implications from a risk management vantage point.

We also constantly monitor individual fund returns. If a fund underperforms the benchmark by a certain degree, we review the underlying reasons and prepare solutions. For traditional investments, we restrict investments in countries and products with significant liquidity constraints and regularly monitor portfolio transaction liquidity.

Alternative Investment Risk

The Risk Management Team designates allocation limits for external managers relative to the total net value of our alternative assets and for each asset class. For diversification purposes, the team also monitors the degree of concentration by region, strategy, sector and vintage. In 2020, to achieve a stable alternative investment portfolio, we managed concentration risk by reducing the maximum amount of alternative investments entrusted to each GP. Of course, we review risk factors for each investment plan prior to making any investment-related decisions. For direct investments or projects with significant risk, the Risk Management Team participates in on-site due diligence with the front office and conducts a prior and independent assessment of risk factors.

Post-investment, the Risk Management Team operates an early-warning system that monitors potential issues related to investment projects by classifying them according to profit and loss levels. Our team has also adopted and integrated a Public Market Equivalent analysis, analyses of alternative investment market indices, relative performance comparisons by vintage year and quantitative model analyses for the alternative investment portfolio using private market risk factors.

Credit Risk

KIC classifies credit risks into securities-related credit risks and counterparty credit risks. To manage credit risks from securities, we designate the lowest grade eligible for investments based on credit ratings by Moody’s, S&P and Fitch Ratings, and set investment ceilings by issuers of corporate credit.

We manage counterparty risks by setting a minimum credit rating, selecting and managing appropriate counterparties and designating exposure limits based on credit ratings. We have also established an internal counterparty assessment system that uses such factors as counterparty credit ratings and various types of credit risk information and have regularly monitored counterparty risks. In 2020, we strengthened our management process for counterparties by analyzing their transaction data and excluding those that did not meet our internal evaluation standards.

Derivatives Risk

Derivatives are invested on a limited basis to enhance returns and make portfolio adjustments. To prevent excessive leverage transactions, we manage risks by designating investment-eligible derivative products and assigning position limits. For derivative financial products used in various investment strategies, we work to effectively integrate and monitor investment data by checking each counterparty’s transaction and exposure management status.

Operational Risk

Operational risk management aims to prevent KIC from incurring financial losses arising from risks associated with inappropriate internal processes, employees, systems and external factors. KIC has developed and conducts employee self-check surveys to better control operational risk.

In terms of organizational structure, we have separated the front, middle and back offices to maintain an effective system of checks and balances. Operational processes for the settlement of accounts and accounting related to the management of entrusted assets, as well as our IT systems, are designed to ensure effective operational risk control. The Chief Compliance Officer oversees all matters related to operational risk management activities independently, to protect the interests of sponsors and prevent financial mishaps.

Legal Risk

To prevent and manage legal risks, we review investment agreements, investment structures and potential issues prior to all investments. We also use a post-management system to ensure our investor interests and rights. For our alternative investment portfolio, which we seek to further diversify, we conduct legal reviews in consideration of the characteristics of each asset class. We also analyze domestic and foreign laws and amendments for pending issues to mitigate legal risks from various angles. Recognizing the growing importance of preventing and responding to legal risks, we have expanded our pool of legal experts, provided staff with additional training and seminars and, in 2020, exchanged information with related agencies virtually due to the limitations imposed by Covid-19. We are also working more with domestic law firms to contribute to the development of Korea’s finance industry.