Alternative Investments

Alternative investments allow for an illiquidity premium, which can help

KIC achieve outstanding returns as a long-term investor.

Alternative investments play a critical role in diversifying overall portfolio risk and increasing investment efficiency due to their low correlation with traditional investments. They also allow for an illiquidity premium, helping KIC, as a long-term investor, achieve outstanding returns.

KIC started investing in alternative assets in 2009 with private equity and steadily broadened our investment spectrum to include real estate, infrastructure and hedge funds. The result is a balanced alternative portfolio that can support efficient overall portfolio management through investments diversified by vintage, region and strategy.

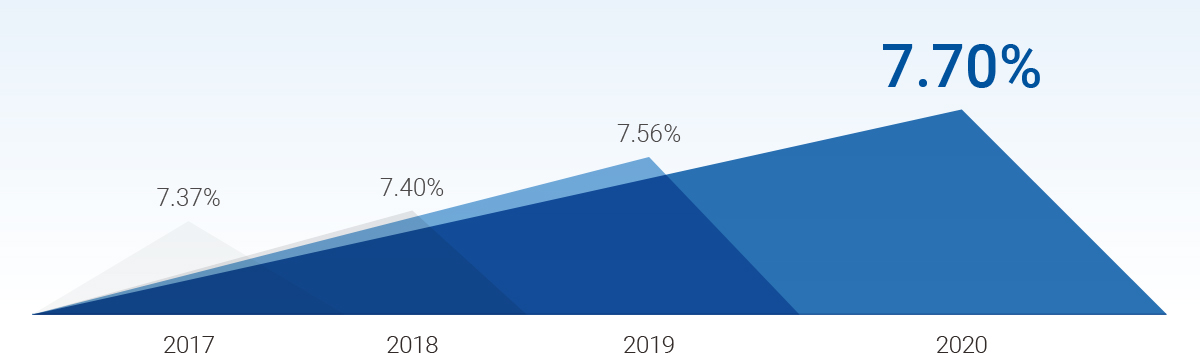

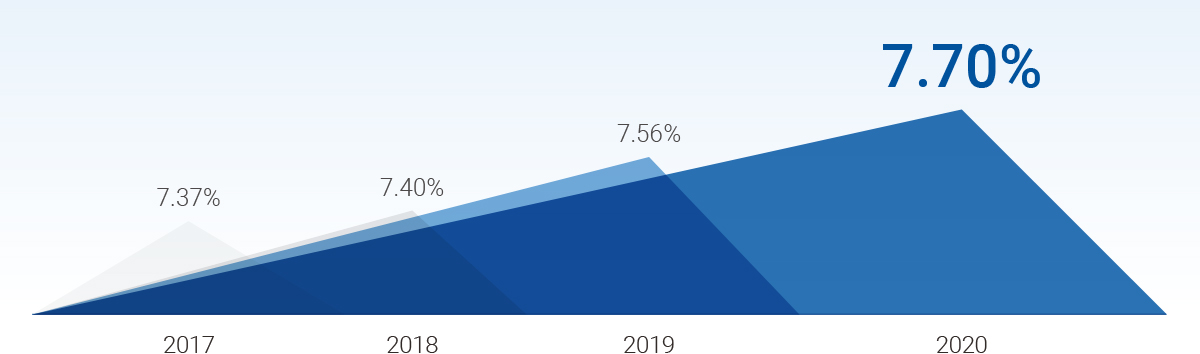

To achieve higher returns, we continue to expand our global network of sovereign wealth funds, pension funds and GPs and explore promising investment opportunities, including co-investments. As of the end of December 2020, KIC’s annualized investment return since inception for alternative investments was 7.70%.

Private Equity

Private equity, categorized as an illiquid, growth-oriented long-term investment within the alternative asset portfolio, is an investment strategy that provides a higher return than other asset groups. KIC established the alternative investment division in 2009 and started investing in private equity funds immediately following the global financial crisis. We began making direct private equity investments in 2010 and co-investments with existing GPs in 2011, diversifying our portfolio by region and strategy.

The first half of 2020 saw a sharp decline in new investments and divestments in the private equity market compared to the previous year due to the Covid-19 pandemic and resulting economic contraction. But the market recovered to 2019 levels thanks to measures by major governments and central banks.

KIC also manages the KIC Venture Growth (KVG) fund to discover promising technology assets amid rapid changes in today’s technological paradigm. And to manage the risk of an increase in the market prices of assets relative to their real value, KIC increased the proportion of private credit and secondary assets. We strive to ensure long-term stable returns by building a diversified portfolio around excellent assets for each region and strategy.

Annualized return since inception

- 2017

- 7.37%

- 2018

- 7.40%

- 2019

- 7.56%

- 2020

- 7.70%

Real Estate

Real estate is one of the main alternative asset classes that can help diversify a portfolio. KIC has been making a diverse range of direct, indirect and co-investments in real estate in North America, Europe and Asia since 2010.

The Covid-19 pandemic in 2020 marked a turning point for the global real estate market, resulting in increased uncertainty and a sharp decline in transactions. By sector, demand for hotel and retail real estate investments plunged due to travel restrictions and social distancing. Investment demand for logistics facilities, which were expected to benefit from the growth in e-commerce and digitization, remained steady.

In this environment, KIC sought investment opportunities in promising real estate assets in major cities and countries, increasing our investments in assets likely to benefit from secular trends and in core assets in major cities that would generate steady cash flows.

Infrastructure

Infrastructure assets generate long-term predictable cash flows by providing services and facilities essential to society and offer protection against inflation through inflation-linked income streams.

Since KIC’s first infrastructure investment in 2010, we have built a portfolio diversified by geography, including North America, Europe and Asia, and invested across a variety of sectors ranging from conventional power, energy & utilities and transport to renewable energy and telecommunication.

With more people working from home and classes moving online in 2020 due to Covid-19, the world saw a rise in data traffic and demand for telecommunications infrastructure such as fiber networks, data centers and telecom towers. Countries also continued to switch from fossil fuels to eco-friendly energy sources to meet their carbon-reduction targets, which created investment opportunities in related sectors.

In line with these market trends, KIC last year co-invested in telecommunications infrastructure companies in North America and Europe and in a district energy company in Europe. We also invested in the renewable energy sector in emerging markets. We continue to seek stable investment returns by creating a diversified portfolio that reflects such secular trends as increased data traffic, aging populations and a transition to renewable energy.

Hedge Funds

As an asset class that pursues absolute returns, hedge funds offer a wide range of investment strategies and techniques. From a risk-return perspective, they have a relatively low correlation with economic cycles, traditional assets and other alternative assets, including private equity and real estate.

KIC started investing in hedge funds in 2010. We have gradually developed our portfolio by diversifying investments across multiple hedge fund strategies to achieve stable and long-term returns in a manner complementary to other asset classes.

In 2020, the effectiveness of some strategies, including commodity trading adviser (CTA), declined due to increased market volatility resulting from the pandemic. The gap among hedge fund investment management companies broadened. In response to this polarization, KIC focused on building a foundation to generate stable, long-term returns by reducing the CTA strategy and selecting GPs with custom solution strategies.

In light of rising asset prices, increased volatility in financial markets and changes and trends in the finance sector, KIC will make diverse investments through outstanding GPs to take advantage of such arbitrage opportunities as equity L/S, global macro and event-driven strategies.