Investment Policy & Process

KIC’s investment policy and process focus on improving long-term

returns through stable asset management.

Investment Objective

KIC’s investment objective is to generate consistent and stable investment returns within appropriate risk limits to preserve and increase the value of Korea’s sovereign wealth.

Investment Principles

Based on principles of prudent and responsible investing, KIC diversifies investments across asset classes and regions, ensuring that overall portfolio risk remains within appropriate levels to increase returns in a sustainable manner.

Asset Classes

KIC invests in traditional and alternative assets. Traditional assets include listed or highly liquid financial assets such as equities and fixed-income investments. Alternative assets, which can capture risk premiums associated with illiquid investments, include private equity, real estate, infrastructure and hedge funds.

Investment Guidelines

The investment guidelines provided by our sponsors stipulate the objectives, benchmarks, risk tolerance limits and other key guidelines for mandated investments and serve as the basis for all investments, risk management and performance assessments at KIC. KIC has also established internal investment guidelines for all asset classes, including equity, fixed income and each fund type.

Asset Allocation

KIC establishes investment targets based on the nature and objective of assets and is strengthening the role and function of asset allocation based on the financial market environment, characteristics of each asset class and investment horizon. We hold an asset allocation forum every quarter to integrate the top-down and bottom-up views from various investment departments and formulate a house view to ensure a reliable asset allocation process.

KIC’s asset allocation system consists of strategic asset allocation, strategic tilting and tactical asset allocation, which are implemented according to investment horizon and role.

Strategic asset allocation defines the role and function of each asset class and sets the policy portfolio based on expected returns and risks on a long-term horizon. Strategic tilting aims to increase returns by adjusting asset allocation against the policy portfolio on a mid-term horizon. Tactical asset allocation pursues excess returns through using alpha strategies and managing risks via various hedging strategies in the event of short-term market volatility.

Direct and Indirect Asset Management

KIC manages traditional assets directly by trading in financial markets and indirectly through external managers.

For direct investments, we pursue stable returns with relatively low risk and marginal excess returns compared to the benchmark. For indirect investments, we use a more active investment strategy that pursues high excess returns with relatively greater risk.

KIC’s Asset Allocation System

- Strategic asset allocation

- Strategic tilting

- Tactical asset allocation

Risk Management

KIC minimizes unnecessary risk and controls downside risk through preemptive and systematic risk management.

Risk limits are set in accordance with risk management policies approved by the Steering Committee. Risk limit compliance is monitored on a regular basis.

Investment-Related Committees

The following investment-related committees at KIC ensure prudent and responsible investment decision-making.

-

- Role: Deliberates and decides on investments

- Composition: CEO (Chair), Chief Investment Officer, Chief Risk Officer, Chief Operating Officer, Head of the Investment Strategy Division and Head of the Alternative Investment Division

-

- Role: Comprehensively review expected investment returns and risks

- Composition: Chief Investment Officer (Chair) and the heads of the investment and risk management departments

-

- Role: Review and assess issues related to risk management

- Composition: Chief Risk Officer (Chair) and the heads of the investment and risk management departments

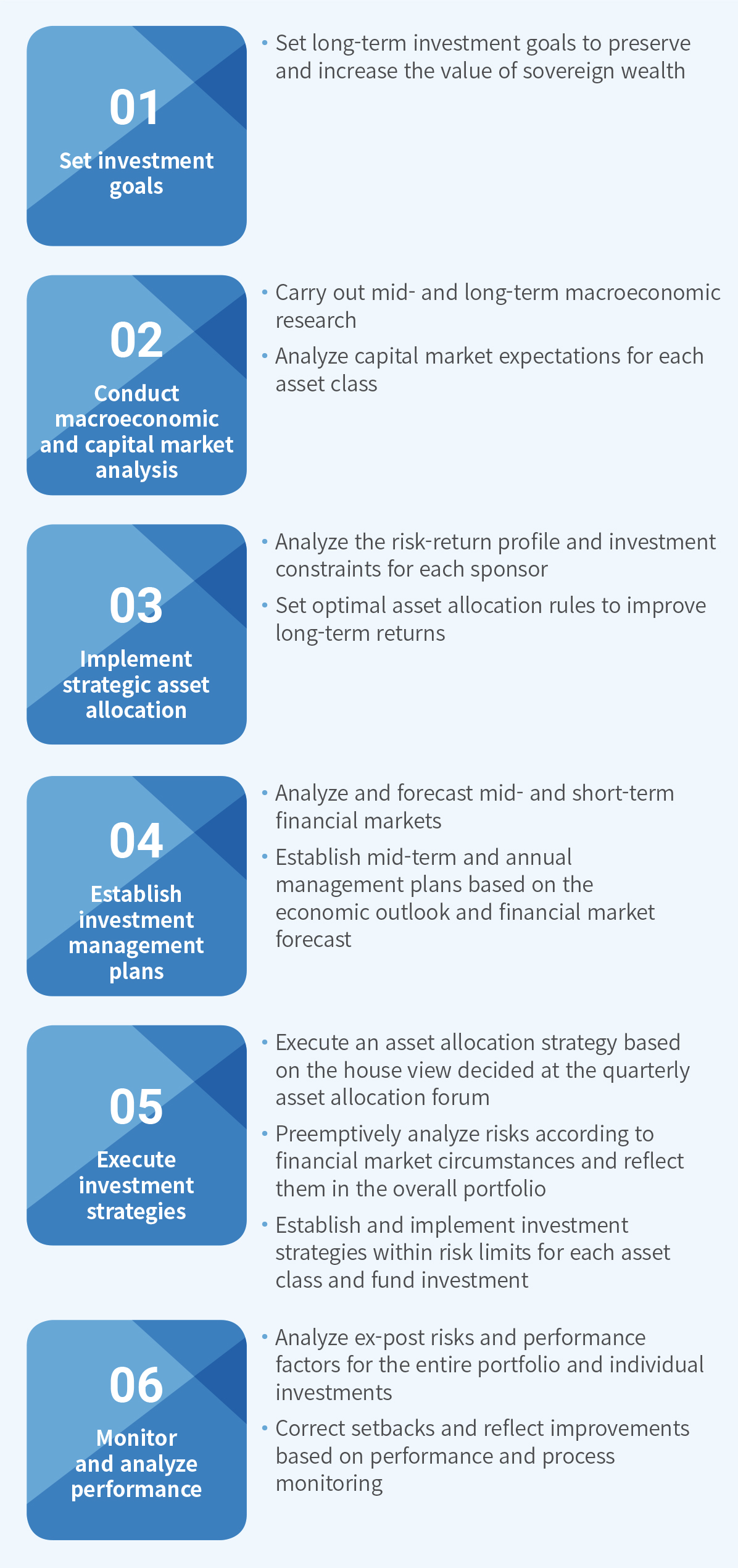

Investment Process

KIC’s investment process is focused on improving long-term investment returns based on stable asset management.

- 01 Set investment goals

-

- Set long-term investment goals to preserve and increase the value of sovereign wealth

- 02 Conduct macroeconomic and capital market analysis

-

- Carry out mid- and long-term macroeconomic research

- Analyze capital market expectations for each asset class

- 03 Implement strategic asset allocation

-

- Analyze the risk-return profile and investment constraints for each sponsor

- Set optimal asset allocation rules to improve long-term returns

- 04 Establish investment management plans

-

- Analyze and forecast mid- and short-term financial markets

- Establish mid-term and annual management plans based on the economic outlook and financial market forecast

- 05 Execute investment strategies

-

- Execute an asset allocation strategy based on the house view decided at the quarterly asset allocation forum

- Preemptively analyze risks according to financial market circumstances and reflect them in the overall portfolio

- Establish and implement investment strategies within risk limits for each asset class and fund investment

- 06 Monitor and analyze performance

-

- Analyze ex-post risks and performance factors for the entire portfolio and individual investments

- Correct setbacks and reflect improvements based on performance and process monitoring