Traditional Investments

Traditional investments, which include equities, fixed income and asset

allocation, comprise a major part of KIC’s portfolio.

Traditional investments, including equities and fixed income, account for 84.7% of KIC’s total portfolio, playing a central role in our pursuit of investment targets.

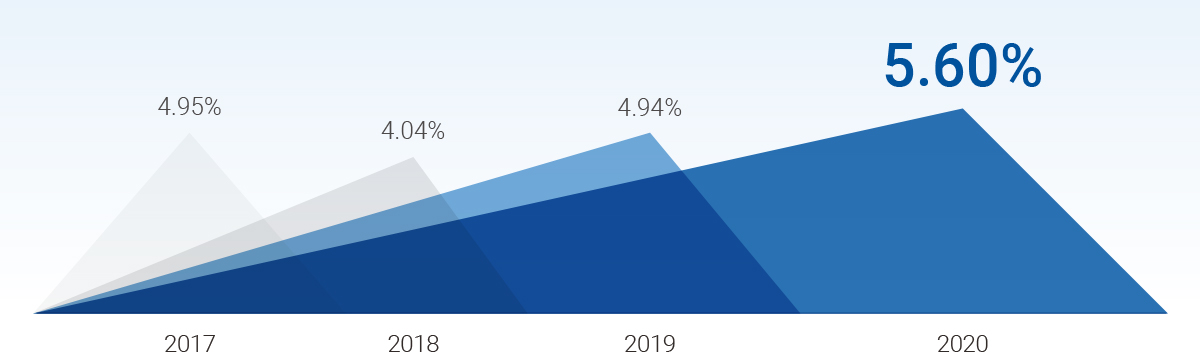

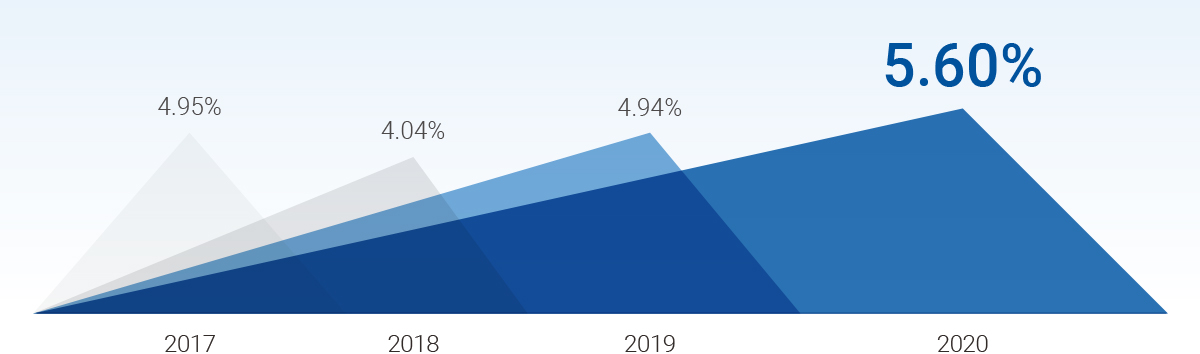

We started with fixed-income investments in 2006 and expanded our asset classes to include equities, inflation-linked bonds and more. The annualized return for KIC’s traditional investments as of 2020 was 5.6%.

As the scope and scale of our investments grew, so did the need to adjust our asset class weights and to pursue companywide risk management. We started an asset allocation forum in 2019 in which KIC’s investment managers can engage in in-depth discussions, with forum results being reflected in KIC’s decision-making process.

While each investment group aims to generate excess returns through using various strategies, the Asset Allocation Team analyzes capital market expectations for each asset class based on financial market forecasts and sets optimum allocations based on companywide risk levels, contributing to the achievement of KIC’s absolute return targets.

Through these functions, KIC maximizes the effectiveness of investment diversification and maintains portfolio-wide risk at appropriate levels, which helps generate returns in a sustainable manner.

Macroeconomic Analysis

KIC conducts multi-faceted global macroeconomic research for effective asset allocation, using the findings to determine short-term market responses and to construct mid- and long-term portfolios. We are laying the groundwork to better respond to changes in the investment environment in consideration of the economic structures and political/social issues of major countries.

We also actively communicate with investment managers worldwide to share and verify investment ideas and global economic and market forecasts, using what we know and learn to best build our investment portfolio and improve returns.

Annualized return since inception

- 2017

- 4.95%

- 2018

- 4.04%

- 2019

- 4.94%

- 2020

- 5.60%

Equities

KIC pursues excess returns by investing in publicly listed companies worldwide that are undervalued relative to their long-term intrinsic value. Our goal is to consistently achieve excess returns in accordance with investment guidelines.

KIC’s fundamental strategy for direct investments in global equities aims to generate excess returns by analyzing the intrinsic value of companies and industries. In 2020, we extensively applied the Global Core Strategy adopted in 2019, which yielded excellent returns. We also expanded our region-specific portfolios with the expertise of equity investment managers at our New York and London offices.

For our externally managed equity portfolio, KIC uses strategy diversification to enhance performance and respond to market dynamics. We aim to strengthen portfolio management in a balanced manner and work closely with our New York and London offices to discover new strategies. As a long-term investor, we also strive to better apply environmental, social and governance (ESG) criteria to our investments.

For quantitative investments, our long-term goal is to develop KIC’s direct investment capabilities. We have built a global portfolio management and trading system through benchmarking advanced systems overseas. After starting with a passive strategy in 2008, we adopted a quantitative alpha (excess return) model through which investment decisions are made using algorithms based on mathematical and statistical models. We use an enhanced strategy to improve cost efficiency and returns.

KIC also uses an independently developed management platform for quant investments to respond to a global investment environment that is rapidly changing due to technological innovations including the diversification of sources for big data and alternative data and advancements in artificial intelligence (AI) and machine learning. With this next-generation quant platform and other investment management strategies, we work to incorporate AI and big data technology into our investment management.

Fixed Income

KIC invests in bonds and currencies from various countries, including sovereign bonds, bonds issued by state-run agencies, corporate bonds and securitized bonds. We manage risk factors in the global fixed-income market, including credit and liquidity risk, and adhere to investment guidelines for optimal portfolio management.

For the directly invested fixed-income portfolio, we use regional and sector-specific expertise derived through collaboration between headquarters and our overseas offices to systemically manage a broad global portfolio, diversify risk and pursue stable excess returns.

In 2020, for the directly invested portfolio, we strengthened our credit analysis and investment capabilities, diversified macro strategies based on mid- and long-term macroeconomic research and policy outlooks and developed sector allocation strategies.

We also diversified our external fixed-income portfolio last year by adding unconstrained strategies to enhance absolute returns. We strategically allocated ex-ante tracking errors between the internal and external portfolios using a proprietary risk monitoring system to achieve higher long-term returns.

Tactical Asset Allocation

KIC has established a tactical asset allocation strategy to improve overall returns and implemented related processes. The strategy entails adjusting the weight of asset classes based on allocation for spot markets, hedging strategies and alpha strategies, thereby managing total return volatility for traditional assets and improving returns.

In 2020, KIC developed quantitative indicators based on both scenario analyses following financial market changes and economic and market data. We also strengthened our internal system for portfolio management and risk analysis.