2024 Annual Report

Investment Highlights

Investments

Governance & Organization

Risk Management

The aim of KIC’s risk management is to control investment risk within set

limits and appropriately manage potential losses. KIC has a risk management

system that provides comprehensive control solutions for managing risk at

every stage—not only across the front, middle and back offices, but also

within corporate management.

The Steering Committee deliberates on and makes decisions regarding risk management policy, while the Board of DirectorsBOD allocates risk limits and establishes risk management guidelines. The Risk Management Subcommittee (under the Steering Committee) and the Risk Management Working Committee (under the BOD) develop detailed risk management guidelines through in-depth discussions.

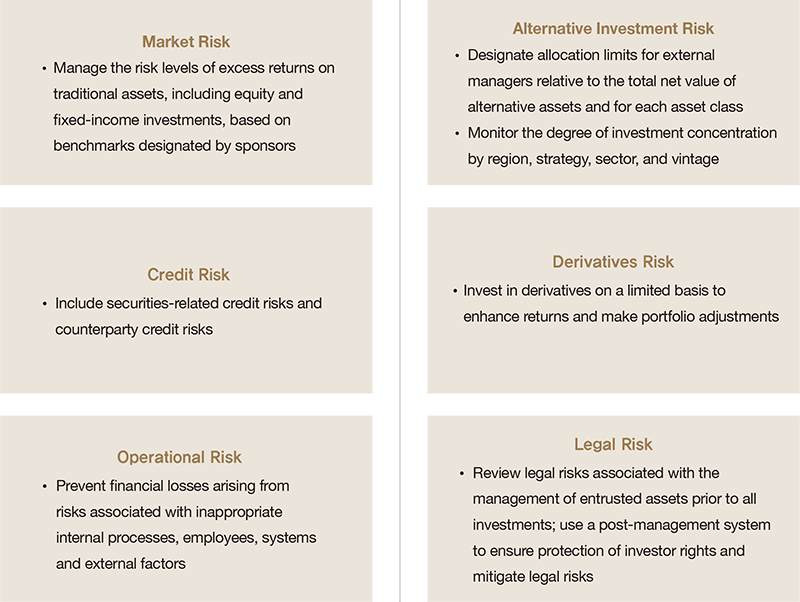

KIC manages market risk, alternative investment risk, credit risk, derivatives risk, operational risk and legal risk. We adopt quantitative indicators and limits to measure each type of risk, and assess and monitor these indicators throughout the investment process. When key risks exceed set limits, the Risk Management Working Committee examines the issue and discusses possible solutions. To supplement quantitative analyses, we also conduct various types of qualitative analyses.

To ensure the independence and autonomy of the risk assessment and investment monitoring processes, the Risk Management unit is strictly separated from the Investment Management unit.

Risk Management

Market Risk

For traditional assets such as equities and fixedincome investments, KIC manages the risk level of excess returns based on benchmarks designated by sponsors. Market risk for traditional assets is primarily measured by the volatility of excess returns relative to benchmarks. KIC sets and manages limits through ex-ante tracking error.

In 2024, to actively respond to financial market volatility, KIC maintained the ex-ante tracking error of the integrated portfolio between a minimum of 22 bps and a maximum of 54 bps. By asset class, risk levels were maintained at 30-55 bps for equities and 12-30 bps for fixed-income investments. KIC views ex-ante tracking error as a metric for generating excess performance compared to benchmarks and allocates and manages it efficiently across various strategies, reflecting market conditions.

Additionally, KIC measures and monitors indicators such as Value at Risk and Conditional VaR (or Expected Shortfall) to estimate portfolio volatility in line with absolute return targets at the asset allocation level.

KIC also prepares for risk under various conditions using stress testing techniques. In particular, stress tests assume extreme situations that include not only historical events but also hypothetical future cases. For example, KIC examines high-intensity situations such as the impact of inflation surges on the performance and correlation of asset classes including equities, fixed-income and alternatives; the effect of geopolitical factors like prolonged wars or changes in Covid-19 response policies on the portfolio; and shifts in equity portfolio sensitivity during market crises.

Through these methods, KIC estimates potential investment losses from multiple angles and incorporates the results into the investment decisionmaking process.

To address the limitations of quantitative models, KIC conducts model backtesting to validate risk models and calculates auxiliary indicators such as CoVaR.

KIC also designates investment-eligible asset classes, sets risk limits by asset class, country, currency and industry and establishes allocation limits for each external manager as well as bond duration ranges.

We continue to improve our risk management system by identifying current issues through meetings with global institutions, among other efforts. We also closely monitor financial market trends by reviewing key market risk factors and analyzing their implications from a risk management perspective

If a fund underperforms its benchmark beyond a certain threshold, we review the underlying reasons and develop appropriate solutions. In doing so, we consider the impact of these factors not only on the individual fund but also on the portfolio as a whole. For traditional investments, we restrict investments in countries and products with significant liquidity constraints and regularly monitor portfolio transaction liquidity.

Alternative Investment Risk

The Risk Management Group sets allocation limits for external managers based on the total commitments of our alternative assets and for each asset class. To ensure diversification, the group also monitors concentration levels by region, strategy, sector and vintage.

Before investment decisions are made, the Risk Management Group reviews the risk factors of each project and independently presents its opinion to the Investment Committee. For major investments such as direct deals, it also participates in on-site due diligence and conducts risk reviews following deliberation by the Risk Management Working Committee.

Post-investment, the Risk Management Group monitors performance based on the profit and loss of each project. It has also adopted and integrated Public Market Equivalent analyses, alternative investment market index tracking, relative performance comparisons by vintage year, quantitative modeling using private market risk factors and key risk indicator analysis for individual investments.

Credit Risk

KIC classifies credit risk into securities-related credit risk and counterparty credit risk.

To manage credit risk from securities, we designate the lowest eligible investment grade based on credit ratings from Moody’s, S&P and Fitch Ratings, and set investment ceilings by issuer for corporate credit.

KIC manages counterparty credit risk through careful counterparty selection and oversight, establishing minimum credit ratings and assigning differentiated investment limits. To support this, KIC utilizes various external credit risk sources, such as counterparty credit ratings, and also maintains an internal evaluation system to periodically assess credit risk. In addition, KIC monitors potential risk factors, such as interest rate volatility or commercial real estate issues, that may affect counterparty creditworthiness.

To respond to heightened market volatility and liquidity risk, KIC monitors counterparty credit risk through various means, including in-depth analyses of risks related to securities lending and collateral liquidity.

Derivatives Risk

KIC invests in derivatives on a limited basis to enhance returns and make portfolio adjustments. To prevent excessive leverage, we manage risk by designating investment-eligible derivative products and assigning position limits. We also monitor each counterparty’s transaction status and exposure to ensure effective investment data integration and oversight.

Operational Risk

Operational risk management at KIC seeks to prevent financial losses resulting from internal process failures, personnel issues, system errors or external events. KIC has developed and implements self-assessment surveys for employees to help control operational risk.

Structurally, we maintain clear separation of the front, middle and back offices to ensure checks and balances. Processes for settlement and accounting related to the management of entrusted assets, along with our IT systems, are designed to support effective operational risk management.

Legal Risk

KIC takes a comprehensive approach to legal risk prevention and management through robust internal procedures, effectively addressing legal issues and potential legal disputes. We proactively review investment contracts and structures to identify key issues across both traditional and alternative assets, implementing preemptive solutions and postinvestment response systems to protect returns and safeguard investor rights.

As KIC continues to diversify its alternative asset portfolios and investment strategies, our Legal Group conducts increasingly detailed and systematic legal reviews. These reviews take into account the specific characteristics of each asset class, investment strategy and transaction structure. KIC also analyzes varied domestic and global regulatory landscapes to prevent and mitigate legal risks.

Recognizing the rising importance of legal risk management, KIC continuously strengthens its internal legal capabilities. This includes expanding our Legal Group, implementing company-wide knowledgesharing initiatives and deepening collaboration with relevant institutions. By working closely with domestic legal advisory firms on investment reviews, KIC also contributes to the development of Korea’s finance industry.