2024 Annual Report

Investment Highlights

Investments

Governance & Organization

Investment Stewardship and Sustainable Investment

At KIC, we are expanding sustainable investments that incorporate environmental,

social and governance (ESG) factors to pursue long-term, stable returns.

Through doing so, we contribute to the sustainability of Korea’s sovereign wealth.

Sustainable Investment

KIC established its Stewardship Principles in 2018 to clearly define the objectives of its stewardship activities. At the same time, we began enhancing our role as Korea’s sovereign wealth fund through sustainable investments that consider non-financial metrics, including environmental, social and governance (ESG) factors. This marked our first step toward supporting the global agenda for sustainable development, in line with global capital market trends. In September 2019, KIC included a responsible investment clause in its Investment Policy Statement, the authoritative guide to KIC’s investment philosophy, principles and processes. The following month, KIC established the Responsible Investment Guidelines to define our sustainable investing procedures and standards.

Then, in 2021, the National Assembly of Korea amended the Korea Investment Corporation Act to provide a legal foundation for KIC’s pursuit of sustainable investing. In accordance with this legislative framework, KIC integrates ESG factors throughout the investment process and strives to increase stable, long-term returns.

ESG Integration

KIC has implemented ESG integration across all asset classes and portfolio strategies, establishing a sustainable investment framework aligned with global best practices.

We apply ESG considerations to both traditional and alternative assets, in direct and indirect investments alike. By identifying ESG factors that could affect the value of investees and taking appropriate action during the investment process, we aim to enhance long-term asset value and returns. Our efforts include the following:

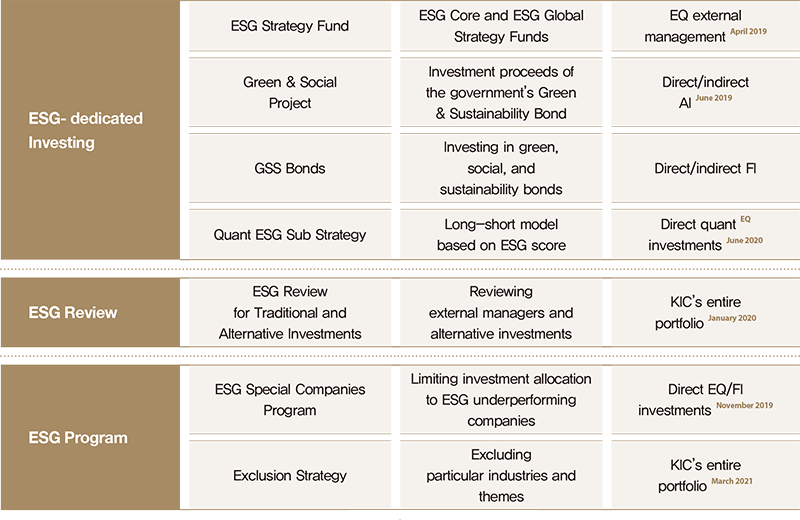

First, we pursue sustainable investments, which consider ESG factors as a core investment theme. They include ESG equity strategy funds and green and social projects within alternative investments. KIC also invests in green, social and sustainability bonds and has ESG-themed quant sub-strategies that integrate ESG factors at the portfolio level.

Second, KIC conducts ESG reviews of all its traditional and alternative asset managers, as well as on direct investments and co-investments in alternative assets. Using ESG questionnaires and on-site inspections, we assess each firm’s ESG policies and whether those policies are embedded in the investment process. We also review ESG factors of individual projects from multiple angles and reflect the findings in our investment decisions.

Third, KIC actively addresses climate-related risks. We conduct detailed assessments of carbon emissions across equity and fixed-income investments at the portfolio level. We have also expanded this work to include climate scenario analyses and have disclosed our findings in our Sustainable Investment Report since 2022 based on Task Force on Climate-related Financial Disclosures (TCFD) standards.

Fourth, KIC limits investments in companies with low ESG scores by maintaining a watchlist. We also operate an ESG program that incorporates exclusionary strategies, avoiding investments in themes and industries identified as problematic from an ESG perspective.

Beyond policy development, KIC launched an ESG strategy fund in 2019. It tracks an ESG index that adjusts constituent weightings based on ESG scores, and it was the first global ESG strategy fund in Korea to adopt this methodology.

Since then, KIC has increased its allocations to ESG strategy funds and diversified these strategies into ESG Core and ESG Global. In response to the fastevolving ESG landscape, we are also developing new ESG strategies. From a long-term perspective, KIC will continue to monitor and evaluate ESG strategy fund performance while proactively seeking new opportunities to create future value and establishing advanced ESG investment strategies.

In 2019 and 2021, KIC received green and sustainable fixed-income issuance funds from the Korean government (Ministry of Economy and Finance), which we have been investing in green and social projects. Following investment execution, we disclose both environmental impacts—such as greenhouse gas emissions reductions and renewable energy generation—and social outcomes, including job creation and increased access to medical and educational services.

Through these initiatives, KIC seeks to strengthen investor confidence in Korea’s green and sustainable sovereign bonds, promote the growth of global ESG investing and contribute over the long term to achieving the United Nations Sustainable Development Goals. Looking ahead, we will continue to strengthen our ESG analysis capabilities and apply sustainable investing practices across our process and portfolio. KIC is committed to delivering strong returns, generating positive environmental and social outcomes and building a sustainable investment model that serves as a global benchmark.

Stewardship Activities

Exercising voting rights is one of the most widely used stewardship activities for overseeing corporate management, governance and sustainability, while enhancing long-term shareholder value. KIC exercises its voting rights in investee companies in accordance with the Santiago Principles, which emphasize the importance of sovereign wealth funds actively exercising shareholder rights, and the KIC Stewardship Principles, adopted in 2018, thereby fulfilling its fiduciary duty/

To strengthen its proxy voting capabilities for the directly managed portfolio and align with global best practices, KIC began working with a global proxy advisory firm in 2019. In 2023, KIC appointed a new advisory firm to better reflect the evolving shareholder rights landscape. Since 2023, KIC has directly exercised voting rights in major investee companies to enhance corporate value as a global investor. And starting in 2024, KIC has expanded the scope of its direct voting in accordance with its shareholder rights roadmap. For indirect investments, voting is carried out by external asset managers. KIC monitors all voting activities and outcomes, with a continued focus on enhancing the long-term value of its investee companies.

Shareholder engagement refers to active communication between companies and investors aimed at enhancing corporate value. This includes direct dialogue with management, written inquiries and shareholder letters. Such engagement contributes to improved management practices and has a positive impact on corporate value over the medium to long term. Effective engagement has become a key component of value-enhancement strategies, particularly in Asian markets.

As Korea’s sovereign wealth fund and a global investment institution, KIC integrates the UN Sustainable Development Goals (SDGs) into its shareholder engagement efforts and monitors the progress of related initiatives. Through this approach, KIC contributes to enhancing the value of its investee companies.

Partnerships

KIC has actively built sustainable investing partnerships with institutional investors in Korea and abroad. In 2019, KIC became the first Korean institutional investor to join the International Corporate Governance NetworkICGN. In 2020, we joined the One Planet Sovereign Wealth FundsOPSWF, an initiative to respond to climate change. We were also the first Korean public institutional investor to pledge support for the Task Force on Climate-related Financial DisclosuresTCFD. In 2022, we joined the UN Principles for Responsible InvestmentPRI, the world’s largest sustainable investment initiative. Through these and other efforts, we continue to expand partnerships with global institutional investors through exchanges focused on sustainable investment.

In 2020, KIC became the first domestic public investor to publish a Sustainable Investment Report. In its 2024 report, KIC showed that it has strengthened its climate change analysis with emission pathway predictions and diversified scenarios, while adding case studies on proxy voting for emerging ESG issues such as generative AI. The report also included, for the first time, KIC’s sustainable management status.

KIC hosts the annual KIC ESG Day to promote information sharing on ESG investment among domestic institutional investors and to encourage dialogue on responsible investing. In 2024, KIC held the 6th KIC ESG Day, which was themed “ESG Investment Strategies and AI Use Cases” and featured global investment managers from both the public and private sectors. The event included lively presentations and discussions on how environmental, social and governance factors can be integrated into investments through AI. KIC plans to continue strengthening partnerships with domestic institutional investors and actively share responsible investment strategies and practices to enhance returns.

Stewardship Principles

| Principle 1 | Establish and publicly disclose our principles on investment stewardship and how we will fulfill our stewardship responsibilities. |

|---|---|

| Principle 2 | Have a robust internal approach for managing conflicts of interest that may arise in our stewardship activities |

| Principle 3 | Regularly monitor portfolio companies to preserve and enhance value over the medium to long-term |

| Principle 4 | Develop a process for engaging with investee companies, where necessary, on key matters relevant to the delivery of medium- to long-term value creation and preservation |

| Principle 5 | Establish a voting policy and procedures for exercising shareholder rights in a manner aligned with the creation and preservation of investor value |

| Principle 6 | Report periodically on stewardship activities |

| Principle 7 | Commit to appropriate training, development, resourcing and collaboration for good investment stewardship |