2024 Annual Report

Investment Highlights

Investments

Governance & Organization

Investment Policy & Process

KIC’s investment policy and process focus on boosting long-term

returns through the management of assets entrusted by the Korean

government and Bank of Korea.

Investment Policy

Investment Objective

KIC’s investment objective is to generate sustainable and stable investment returns within appropriate risk limits to preserve and increase the value of Korea’s wealth.

Investment Principles

KIC adheres to the Prudent Investor Rule, pursuing a diversified investment strategy across asset classes and regions. This approach enables KIC to effectively manage overall portfolio risk while seeking sustainable returns.

Asset Classes

KIC’s portfolio is primarily composed of traditional assets, alternative assets and strategic investments. Traditional assets refer to highly liquid financial assets listed on public exchanges, such as equities and fixedincome investments. Alternative assets encompass a broad range of assets outside the traditional space. While they typically offer lower liquidity due to the absence of standardized trading markets, they aim to generate additional returns through illiquidity premiums. Representative alternative assets include private equity, real estate, infrastructure, hedge funds and private debt. Strategic investments refer to assets in which KIC participates as a co-investor in the overseas investments of domestic companies.

Investment Guidelines

Investment guidelines serve as KIC’s standards for managing entrusted assets. They define investment objectives, benchmarks, permitted assets, investment restrictions, performance evaluation criteria and reporting methods. KIC manages assets, controls risks and evaluates performance based on these standards.

Asset Allocation

KIC allocates assets based on financial market conditions, asset characteristics and investment horizons. To strengthen its asset allocation capabilities, KIC holds quarterly asset allocation forums, where it integrates top-down and bottom-up views from investment departments to formulate a house view.

KIC’s asset allocation framework comprises strategic asset allocation, strategic tilting and tactical asset allocation, with each applied according to investment horizon and purpose.

Strategic asset allocation defines the role and function of each asset class and sets KIC’s policy portfolio based on expected returns and risks on a long-term horizon. Strategic tilting aims to enhance returns by adjusting allocations against the policy portfolio on a mid-term horizon. Tactical asset allocation manages the risks of short-term market volatility through various hedging strategies and pursues excess returns through using alpha strategies.

Direct and Indirect Management

KIC manages entrusted assets through both direct and indirect investment approaches. In direct management, internal investment teams manage assets, aiming to achieve stable performance that exceeds benchmarks with relatively low risk.

In indirect management, KIC selects external asset managers to manage assets. This approach employs more aggressive investment strategies targeting excess returns with relatively higher risk.

Risk Management

KIC minimizes unnecessary risk and controls downside risk levels through preemptive and systematic risk management.

We set risk limits in accordance with a risk management policy approved by the Steering Committee, KIC’s highest decision-making body, and regularly check compliance with these limits.

Investment Process

KIC’s investment process is focused on improving long-term returns through stable asset management.

Investment Committee

KIC makes prudent and responsible investment decisions through the following investment-related committees.

Investment Committee

- Role: Deliberates and decides on investments

- Composition: CEOChair, Chief Investment Officer, Chief Risk Officer, Chief Operating Officer and the heads of the Investment Strategy & Innovation, Public Market and Alternative Investment divisions

Investment Working Committee

- Role: Comprehensively review expected investment returns and risks

- Composition: Chief Investment OfficerChairand the heads of the investment and risk management groups

Risk Management Working Committee

- Role: Review and assess issues related to risk management

- Composition: Chief Risk OfficerChairand the heads of the investment and risk management groups

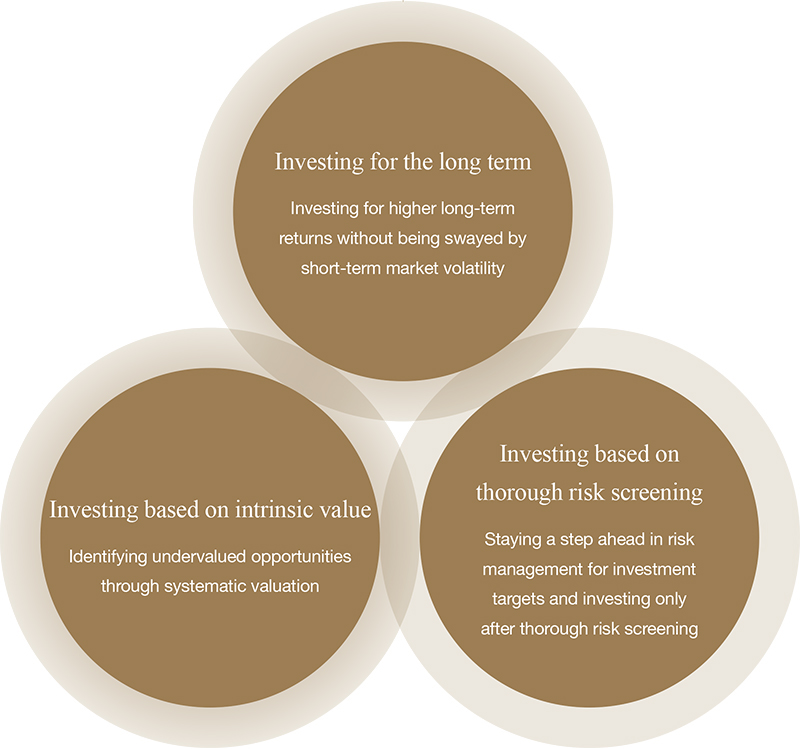

Investment Philosophy