Investment Highlights

Investments

Governance & Organization

INVESTMENTS

Risk Management

The aim of KIC’s risk management is to control investment risk within certain limits and appropriately manage potential losses. KIC has a risk management system that provides comprehensive control solutions for managing risk at every step, for not only the front, middle and back offices, but also corporate management.

The Steering Committee deliberates on and makes decisions regarding risk management policy while the Board of DirectorsBOD allocates risk limits and establishes risk management guidelines. The Risk Management Subcommittee (under the Steering Committee) and the Risk Management Working Committee (under the BOD) arrange detailed risk management guidelines via in-depth discussions.

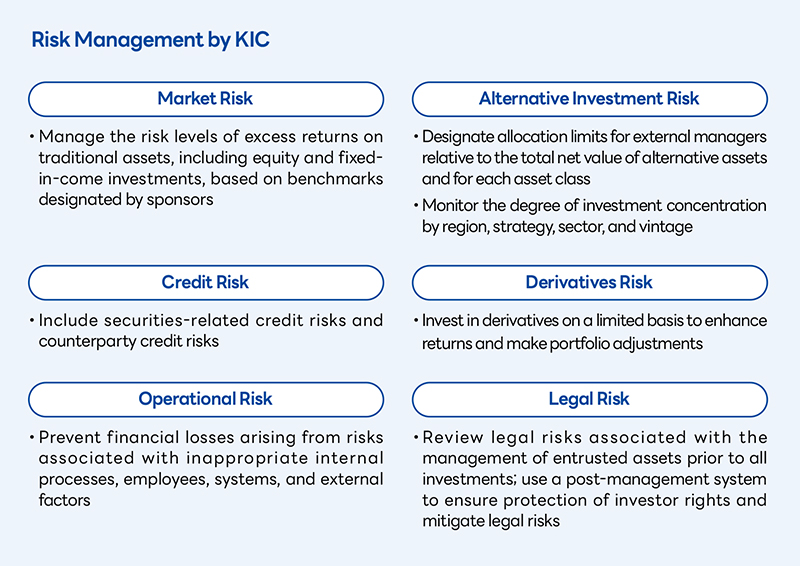

KIC manages market risk, alternative investment risk, credit risk, derivatives risk, operational risk, and legal risk. We adopt quantitative indicators and limits to measure each type of risk, and assess and monitor each risk indicator during the investment process. When key risks exceed limits, the Risk Management Working Committee examines the issue and discusses possible solutions. To supplement quantitative analyses, we also perform various types of qualitative analyses.

To ensure the independence and autonomy of the risk assessment and investment monitoring processes, the Risk Management unit is strictly separated from the Investment Management unit.

Market Risk

For traditional assets including equities and fixed income, KIC manages the risk levels of excess returns based on benchmarks designated by our sponsors. Public market risk is defined as the volatility of excess returns against the benchmark, and we measure, monitor, and set limits using ex-ante tracking errorT/E.

In 2023, in response to financial market volatility, we actively managed the minimum and maximum ex-ante tracking error for the combined portfolio in the 30-50 bps range. By asset class, the tracking error for equity was within 44-68 bps and for fixed income, 21-43 bps. A key source of alpha generation, these tracking errors are effectively allocated and managed across investment strategies.

KIC also measures and monitors indicators including Value at RiskVaR and Conditional VaR, which estimate portfolio volatility for the management of absolute returns from an asset allocation perspective. KIC uses stress test techniques as well to prepare for risks in various situations. The stress tests for extreme situations take into consideration not only simple historical scenarios but also the impact of such hypothetical scenarios as a surge in inflation on the performance and correlation of each asset class, such as equity, fixed income, and alternative assets, and geopolitical variables such as a prolonged war and changes in Covid-19 response policies on portfolios. This helps KIC estimate investment loss from various perspectives and take it into consideration when making investment decisions.

To compensate for the limitations of the quantitative model, model backtesting is used to check the validity of the risk model and auxiliary indicators such as CoVaR are calculated and monitored. KIC also designates investment-eligible asset classes, sets risk limits for the weights of asset classes, countries, currencies, and industries, and establishes allocation limits for each outsourced manager and ranges for bond duration.

We also work to continuously improve our risk management system by identifying current related issues through meetings with global institutions and more. Lastly, we closely monitor financial market trends by reviewing key market risk factors and analyzing their implications from a risk-management vantage point.

If a fund underperforms the benchmark by a certain degree, we review the underlying reasons and prepare solutions. When implementing these solutions, we look at how certain factors impact not just the fund in question, but our portfolio as a whole. For traditional investments, we restrict investments in countries and products with significant liquidity constraints and regularly monitor portfolio transaction liquidity.

Alternative Investment Risk

The Risk Management Group designates allocation limits for external managers relative to the total commitments of our alternative assets and for each asset class. For diversification purposes, the group also monitors the degree of concentration by region, strategy, sector, and vintage.

The Risk Management Group reviews the risk factors of each investment project before making an investment decision and presents its opinion independently to the Investment Committee. For major investments such as direct investments, it jointly participates in on-site due diligence and carries out risk reviews following deliberation by the Risk Management Working Committee.

Post-investment, the Risk Management Group monitors investments based on the profit and loss level of each project. The group has also adopted and integrated Public Market Equivalent analyses, analyses of alternative investment market indices, relative performance comparisons by vintage year, quantitative model analyses for the alternative investment portfolio using private market risk factors, and analysis of the key risk indicators of individual investments.

Credit Risk

KIC classifies credit risks into securities-related credit risks and counterparty credit risks.

To manage credit risks from securities, we designate the lowest grade eligible for investments based on credit ratings by Moody’s, S&P and Fitch Ratings, and set investment ceilings by issuers of corporate credit.

We manage counterparty risks by setting a minimum credit rating, selecting and managing appropriate counterparties, and designating exposure limits based on credit ratings. We have also established an internal counterparty assessment system that uses such factors as counterparty credit ratings and various types of credit risk information to regularly monitor counterparty risks.

To respond to high volatility and liquidity risks in the financial market, KIC monitors counterparty credit risks in various ways, including an in-depth analysis of counterparty credit risks related to securities lending and the liquidity of collateral.

Derivatives Risk

Derivatives are invested on a limited basis to enhance returns and make portfolio adjustments. To prevent excessive leverage transactions, we manage risks by designating investment-eligible derivative products and assigning position limits. We also check the transaction status and exposure management status of each counterparty to ensure effective investment data integration and monitoring.

Operational Risk

Operational risk management aims to prevent KIC from incurring financial losses arising from risks associated with inappropriate internal processes, employees, systems, and external factors. KIC has developed and conducts employee self-check surveys to better control operational risk.

In terms of organizational structure, we have separated the front, middle, and back offices to maintain an effective system of checks and balances. Operational processes for the settlement of accounts and accounting related to the management of entrusted assets, as well as our IT systems, are designed to ensure effective operational risk control.

Legal Risk

To prevent and manage legal risks, KIC reviews investment agreements, investment structures, and potential issues prior to all investments. We also use a post-management system to ensure our investor interests and rights.

As KIC seeks to diversify its alternative asset portfolio and increase the proportion of direct and coinvestments, we are conducting more detailed and systematic legal reviews according to the characteristics of each asset class and investment strategies and types. We are also making a multifaceted effort to manage legal risks through, for example, analyzing domestic and foreign laws and regulations and their amendments on various issues to effectively respond to potential legal disputes.

KIC continues to build its in-house legal capabilities by expanding its pool of professionals, promoting company-wide knowledge sharing, and more widely pursuing information exchanges with related organizations. Through cooperation with Korean law firms, we also strive to contribute to the development of Korea’s finance industry.