Investment Highlights

Investments

Governance & Organization

INVESTMENTS

Investment Stewardship and Sustainable Investment

At KIC, we are expanding our sustainable investments, which take into account environmental, social, and governance factors, to pursue long-term and stable returns. In the process, we contribute to the sustainability of Korea’s sovereign wealth.

Sustainable Investment

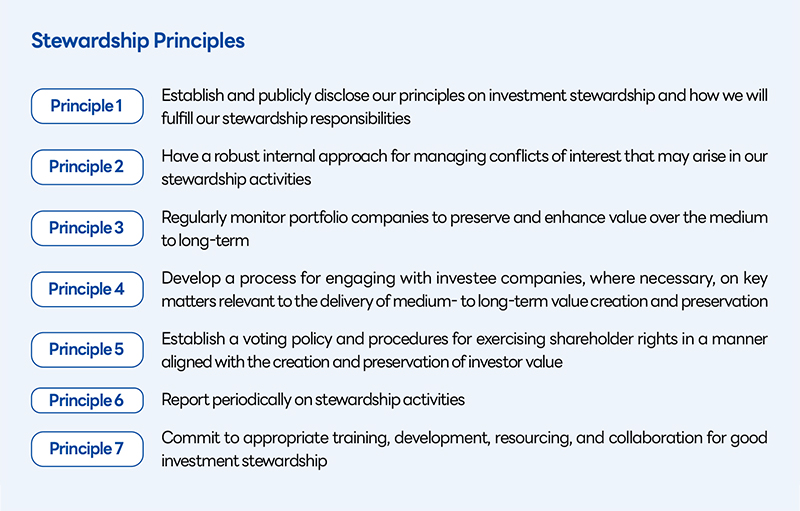

KIC established its Stewardship Principles in 2018 to set clear goals for our stewardship activities. At the same time, we began to elevate our role as Korea’s sovereign wealth fund through sustainable investments that consider non-financial metrics, including environmental, social, and governance (ESG) factors. We also took our first step toward pursuing the global goal of sustainable development, in line with global capital market trends. In 2019, KIC strengthened its sustainable investment policy by adding a sustainable investing article to the KIC Investment Policy, which guides our investment activities, and establishing the KIC Sustainable Investment Guidelines. Then, in March of 2021, the National Assembly of Korea amended the Korea Investment Corporation Act to provide a legal basis for upholding our commitment to sustainable investing. In accordance with laws and regulations, KIC integrates ESG factors throughout the investment process and strives to increase stable, long-term returns.

ESG Integration

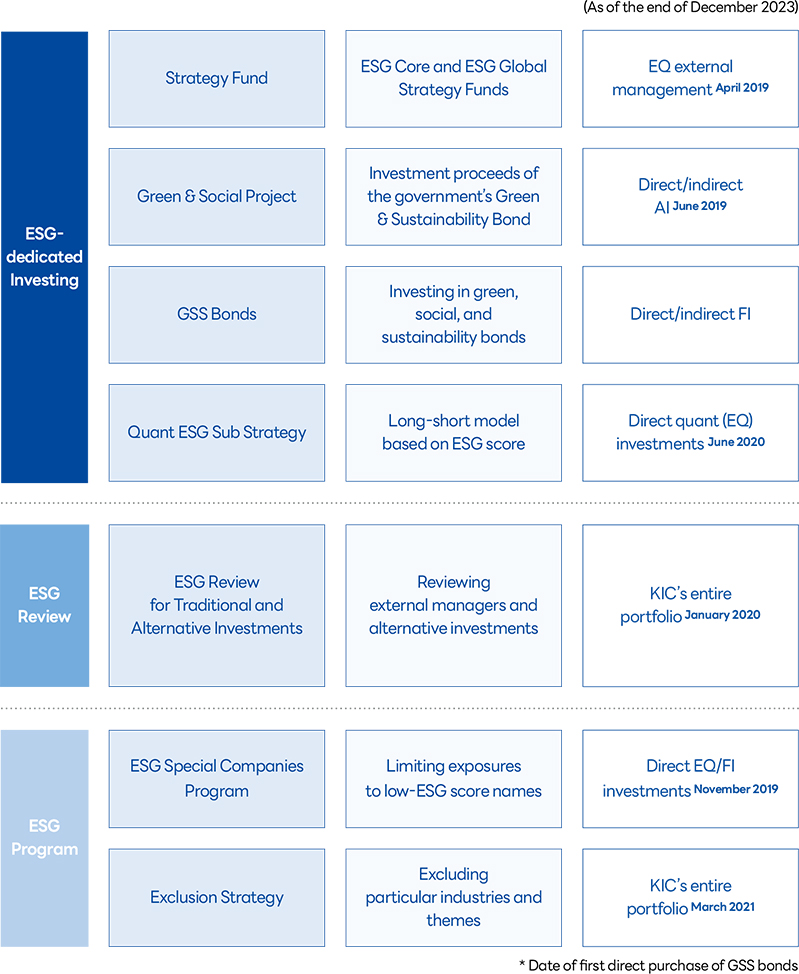

KIC has achieved ESG integration across our asset classes and portfolio, creating a sustainable investment system that meets global standards.

We have integrated ESG factors across our traditional and alternative asset portfolios, in both direct and indirect investments. And through checking ESG factors that can impact the value of investment targets and taking necessary measures during the investment process, we aim to enhance long-term asset value and returns. We do this in the following ways.

First, we engage in sustainable investment, which considers ESG factors as key investment ideas. We have ESG strategy equity funds and green and social projects as alternative assets. We also make green, social, and sustainable bond investments and have ESG-themed quant sub-strategies that integrate ESG factors at the portfolio level.

Second, KIC conducts ESG reviews to examine the ESG-related aspects of all our traditional and alternative asset managers as well as our direct projects and co-investments for alternative assets. We use ESG questionnaires and on-site inspections to check a company’s ESG policy and whether it is reflected in the investment process. We also review the ESG factors of individual projects from multiple perspectives and reflect the findings in our investment decisions.

Third, KIC actively reviews and deals with climate change risks. We identify and closely examine carbon emissions at the portfolio level for our equity and fixed-income investments. We have also expanded the scope of this review to analyze climate scenarios, disclosing the results using TCFD standards in KIC’s 2022 and 2023 Sustainable Investment Reports.

Fourth, KIC limits the proportion of investments in companies with low ESG scores through using a special watchlist. We also run an ESG program that includes a strategy to avoid investing in specific themes and industries deemed problematic from an ESG perspective.

Going beyond the mere reinforcement of policies, KIC has been using sustainable investing as an investment strategy since April 2019, actively managing ESG strategy funds. Based on equity benchmarks, we selected ESG indices after adjusting weightings in consideration of ESG factors. In what was a first for Korea, we introduced a global ESG strategy fund that follows the indices. With this approach, KIC expanded investments in companies that effectively manage ESG risks.

We plan to closely monitor ESG strategy fund performance based on long-term performance and continuously discover new strategies to establish an advanced ESG investment strategy.

KIC also invests in green and social projects with the proceeds of Korea’s green and sustainable sovereign bonds entrusted us (by the Ministry of Economy and Finance) in June 2019 and October 2021. After executing these investments, we examine and disclose their environmental impact, including carbon dioxide and greenhouse gas emission reductions and renewable energy generation, in addition to their social impact, including job creation and usage of medical and educational outreach. In 2023, our disclosures were reviewed by an external organization and reflected in that year’s Sustainable Investment Report. Through these efforts, KIC aims to boost investor confidence in Korea’s green and sustainable sovereign bonds, drive global ESG investment growth and, over the long-term, contribute to achieving the UN Sustainable Development Goals.

Going forward, we will continue to strengthen our ESG analysis and sustainable investing capabilities and apply them across our investment process and portfolio. We strive to increase returns, have a positive impact on the environment, promote sustainability, and build a sustainable investment model that is a global best practice.

Stewardship Activity

Shareholder voting is an integral component of stewardship and a way to monitor business activity and corporate governance to ensure long-term shareholder value. KIC exercises its shareholder rights in line with the KIC Stewardship Principles. For direct investments, we exercise these rights through a global stewardship manager we selected in December 2019 for its expertise and independence. For indirect investments, we vote through our external managers. We keep a comprehensive record of all our voting activity and results, striving to drive long-term value in our investments. In 2023 in particular, KIC began exercising direct voting rights in line with our Stewardship Principles. And we plan to expand the exercising of these rights in stages.

Shareholder engagement is a process that encompasses management discussions, written communications, investor reports, and any other activity that takes place between a business and its investor. Engagement activities tend to lead to an improvement in business results, enhancing corporate value over the long term.

As a Korean sovereign wealth fund and global investment institution, KIC considers the UN Sustainable Development Goals (SDGs) in its shareholder engagement process. By monitoring the progress of activities related to the SDGs, including the status of initiatives and important themes, KIC contributes to enhancing the value of invested companies.

Partnerships

KIC has actively established sustainable investing partnerships with institutional investors in Korea and abroad. In 2019, KIC became the first Korean institutional investor to join the International Corporate Governance NetworkICGN. In 2020, we joined the One Planet Sovereign Wealth FundsOPSWF, an initiative to respond to climate change. We were the first Korean public institutional investor to pledge support for the Task Force on Climate-related Financial DisclosuresTCFD. And in 2022, we joined the UN Principles for Responsible InvestmentPRI, the world’s largest responsible investment initiative to promote sustainable investment. In these and other ways, we expand our partnerships with global institutional investors through sustainable investment focused exchanges.

Notably, KIC is the first Korean public institutional investor to publish a sustainable investment report. We also hold an annual KIC ESG Day to promote the exchange of ESG investment information among domestic institutional investors as well as sustainable investment-focused communication. In 2023, KIC held the 5th KIC ESG Day with the Korea Chamber of Commerce and Industry, inviting international investment managers from the Korean public sector and ESG managers from domestic companies to discuss global shareholder rights. KIC shared about its sustainable investment policy and how sustainable investments can contribute to returns while continuing to expand our partnerships with institutional investors. Through discussing how domestic institutional investors can apply ESG, KIC promotes sustainable investments among domestic institutions.